“This article seeks to delve more into the opportunities around Investment properties for Pension Funds and how Real Estate Investment Trusts can be a solution to the current liquidity problems being faced by Pension Funds.”

ZIMBABWE PROPERTY MARKET

OVERVIEW

The Zimbabwean property market continues to show signs of improvement and resilience, through the increase in demand for rental space for suburban offices and industrial properties. In the 2022 national budget statement, the construction sector was expected to achieve a growth of 10,5%. Zimbabwe’s property market has become a cash market skewed towards the US dollar, although some transactions are still being concluded in Zimbabwean dollars, and at a premium to contain currency and exchange rate risks in an inflationary environment.

Office Market

In an interview by The Zimbabwe Independent, Mike Mujuru CEO of Integrated Properties cited that the CBD offices’ segment remains the worst performing sub-category of the local real estate sector, owing to the policy position allowing residential suburbs in proximity to the CBD to operate as offices. This underperformance has also been influenced by the mushrooming of informal traders on the door-steps and pavements of CBD buildings, lack of adequate parking space and the chaotic traffic in the CBD. Owing to their inherent advantages, office migration from the CBD has been highly pronounced. Beneficiary residential suburbs to this CBD outflow (in Harare) include Eastlea, Hillside, Milton Park, Belvedere, Belgravia, Avondale, and Alexandra Park. This has created an oversupply of CBD office buildings vis-avis demand, leading to high vacancy rates and unsustainably low rental rates.

The CBD office occupancy rate stood at 40-60% as at December 2022 as reported by Knight Frank. This compromises Pension Funds with property in the CBD. The opposite holds true for office spaces in suburban areas, which are experiencing a boom characterized by an average occupancy rate of over 90% as demand outweighs supply. Rentals in the CBD office market averaged US$4 to US$8 per square metre in 2022 and have remained stagnant since 2021. For suburban office spaces, the range is US$6,50 to US$8 per square metre, with higher yields.

Office Market

The housing market remained the best-performing real estate subsector in Zimbabwe. It registered the highest number of transactions and constituted the bulk of activities in the construction sector for 2022. This performance was mainly driven by diasporans, employer mortgage-assisted schemes, informal business owners and business executives. Housing construction has seen growth as new high rises, cluster house developments and gated communities came onto the market in 2022. An estimated annual injection of 60 000 new housing units is inevitable in FY23.

Retail Market

The retail sector has been relatively resilient despite the low consumer disposable incomes. The informal traders have caused a boom in the retail market and vendors are flooding the CBD to maximize on the high volumes of traffic. Rental rates have increased in the CBD ranging from US$20.00 to US$25.00 per square meter due to increased demand for retail space. Rental rates for the suburban locations have generally remained stagnant in the order of US$15.00 to US$20.00 per square meter per month.

Industrial Market

Storage, distribution, and logistics are becoming the predominant use of space in the industrial space as the manufacturing sector continues to be affected by competition from imported goods. Demand for industrial and logistics space is high but is largely unfulfilled due to limited supply. Companies like First Mutual Properties are working to satisfy that portion of the market by constructing urban industrial office parks. One of the latest is Arundel Office Park. Though growth in the sector is hampered by power outages, poor water supply, low-capacity utilization and deteriorating infrastructure, rents have firmed to about $5/m2 for units less than 500sqm. Rental rates have remained stable, achieving US$3.00 per square metre for units of up to about 1000 square metres while larger spaces are achieving more than US$1.00 per square metre.

PENSION INDUSTRY INVESTMENTS OVERVIEW

According to IPEC’s 2023 Q1 Pensions report Investment properties accounted for ZW$924 billion as at 31 March 2023 which constituted 47% of the pensions industry assets. Most private occupational Pension Funds have sought haven in investment properties because of the volatile economy. Total rental income was ZW$8 billion, approximately US$8 million at that time using the auction rate.

14 of the 978 private occupational pension funds are stand-alone self administered funds and they hold 50% of the industry’s investment property. Astonishing right? Of those 14 funds, 9 funds are inactive and mature meaning the level of contributions is not as high anymore. The stand-alone Pension Funds house 46% (438,373) of the industry’s members but have the lowest income level as compared to Insured Funds and Self administered Funds. 81% (ZW$34 billion) of total industry contribution arrears belong to Stand-alone Self-administered Pension Funds. That’s approximately US$34 million at the time of reporting.

49% of the industry assets are under the National Railways of Zimbabwe Contributory Pension Fund (NRZ), Mining Industry Pension

Fund, Local Authorities Pension Fund, and Old Mutual Insured Funds. This means that if anything happens to these 3 stand alone funds and Old Mutual Life Assurance Company this may result in a tremendous impact on the industry. Practical property finance options are needed for the growth of Zimbabwe’s real estate sector, which currently prioritizes hedging over economic growth and income generation. One emerging investment avenue is registering investment property as a Real Estate Investment Trust (REIT).

What are REITs?

A Real Estate Investment Trust (REIT) is a special purpose investment vehilce that owns, operates, or finances income producing real estate. It allows individuals to invest in large-scale, income-producing real estate or related assets. REITs are modelled after mutual funds and pool the capital of numerous investors. They generate a steady income stream for investors but offer little in the way of capital appreciation. Most REITs are publicly traded like stocks, which makes them highly liquid (unlike physical real estate investments). In Zimbabwe REITs are governed by the Collective Investment Schemes Act (24:19) , Income Tax Act (23:06), and the Securities and Exchange Act (24:25).

Formalities of REITs

In terms of the Finance (No. 2) Act, 2020, some of the conditions with regard to the establishment of REITs is as follows:

- In the case of investors in the REIT other than a pension fund, income must accrue from real estate investment projects commenced on or after the date of commencement of the Finance (No. 2) Act, 2020); and;

- The REIT must receive a minimum of eighty per centum of its taxable income from real estate; and

- The REIT must distribute a minimum of eighty per centum of its taxable income in the form of shareholder dividends in each financial year of the REIT; and

- The REIT— I. must have a minimum of 100 shareholders after the first year of the date when it qualifies in other respects to benefit from the exemption under this subparagraph; and II. must not have more than fifty per centum of its shares held by five or fewer individuals during a taxable year: Provided that one or more pension

funds may hold up to fifty per centum of the shares of REIT in any taxable year; and - The REIT must be listed on a stock exchange registered in terms of the Securities and Exchange Act [Chapter 24:25]

This gives pension funds an advantage because they can use their existing assets in setting up a REIT. The trust is exempted from income tax and capital gains tax applies on disposals (except for pension funds). Investors are charged a 10% dividend withholding tax and a 1.5% capital gains withholding tax on the disposal of units.

REIT Registration

- Registration as guided by the Collective Investment Schemes Act (24:19);

- Application for registration has to be made by the Trustee or Manager;

- Application has to be accompanied by:

- A copy of the scheme’s trust deed;

- Prospectus;

- A certificate signed by a legal practitioner (a) certifying that the interest of every participant in the scheme shall consist of the ownership of one or more units (including fractions of units) each representing an undivided share in the property of the scheme; and (b) certifying that the trust deed of the scheme is in conformity with the requirements of the Act.

Trust Deed

- The deed has to be executed by the scheme’s manager and trustee or proposed manager and proposed trustee and must comply with Section 11 of the Collective Investment Schemes Act (24:19);

- The scheme trustee shall be responsible for ensuring that the provisions of the trust deed concerning the scheme’s investment policies and investment restrictions are carried out.

- Items that must be covered in the trust deed are in the second schedule of SI 172 of 1998.

Prospectus

- A prospectus will be required if the issuer is going to invite the public to subscribe to the issue; otherwise, a pre-listing statement should be prepared;

- Required contents of the pre-listing statement/prospectus are specified in Part VII and Part XII of SI 134 of 2019;

REIT Listing Requirements

A REIT issuer must:

- Be registered under the CIS Act as a REIT scheme;

- Have gross assets of at least USD1 million;

- Have at least 30% of the units held by the public, unless a private placement has been done prior to the IPO which results in the free float requirement of 20%

- Satisfactory profit period for the preceding 3 years where applicable;

Benefits for Pension Fund Investors

Diversification – REITs give pension funds indirect exposure to a wide variety of expertly managed properties.

- Regular Income Stream – Income REITs are supported by lease agreements that provide for regular dividends.

- Lower initial outlay – prices for REIT securities are much lower compared to prices for the outright purchase of real estate.

- Taxes – REITs will be exempt from income tax and REIT security holders will only pay the 1% CGWT on disposal of their securities and the 10% withholding tax on dividend earned.

- Liquidity – REITs will be traded on an a stock exchange, a more liquid market compared to that of physical properties.

- Regulated investment – REITs are subject to the Income Tax Act, the CIS Act and the SEC ZIM Act in addition to being listed on a regulated exchange.

- Price Transparency – the price of REIT securities is determined by market forces (demand and supply) and is visible to the public.

Benefits for Pension Fund Issuers

- A tax efficient structure – the exemption from income tax will be a major

attraction to potential investors and that increases investment funds channeled towards REITs

- Access to new investors/capital – which

makes financing developments easier; - Sharing of risks – by bringing other investors on board;

- Liquidity – for Pension Funds and other institutions, this increase liquidity in their property holdings. This will be a major plus for matured funds and inactive funds that no longer receive contributions to improve their investment portfolio structures.

Pension Funds can even resort to paying off pension benefits using REIT units in times when there is low liquidity. Investment in collective investment schemes can go a long way to deal with some of the challenges we are currently facing as an industry. The benefit of being able to convert existing assets into REITs is a major plus for pension funds because of the reduction in investment costs. The non-addition of more investment property in their portfolios helps them to keep them compliant with IPEC investment limit regulations whilst tapping into a good source of income.

Tigere REIT: A Case Study

Tigere REIT is the only listed REIT on the Zimbabwean Stock Exchange. It is managed by Terrace Africa Asset Management. The trust currently operates two main commercial properties namely Highlands Shopping Mall and Chinamano Cnr. The portfolio is collecting a substantial amount of USD in revenue which further drives value proposition to private investors and unit holders with 100% occupancy. From 28 October 2022 when Tigere

announced the listing of its trust up until 28 November 2022 when it was listed for ZWL28 it managed to get 243,647,795 (95.427%) subscriptions of REITs units signalling the huge confidence the market had in the real estate giant. This was according to Tigere’s listing announcement.

It did not end here, 4 months after the listing of Tigere REIT, it declared and paid its quarterly dividend of USD 219,839 consisting of USD 101,325 (being 0.014 United States cents per unit) as well as an additional ZWL110,050,700 (15.29 Zimbabwe cents per unit) in respect of the period ended 31 March 2023. The performance of the REIT assets for the period was in line with expectations and both assets reached 100% occupancy levels. By March 2023, the portfolio had reduced its ZWL exposure to below 20% of revenue and the Asset Manager is now expectant of increased hard currency collections which will result in a higher proportion of USD dividends payable to

unitholders.

In addition, the price of a Tigere REIT unit increased by a whopping 811% from the time it was listed. From ZWL28 to ZWL255.30 in 9 months and a 550% increase in market capitalization. An investment that facilitated both capital gains and dividend payments in a short period!

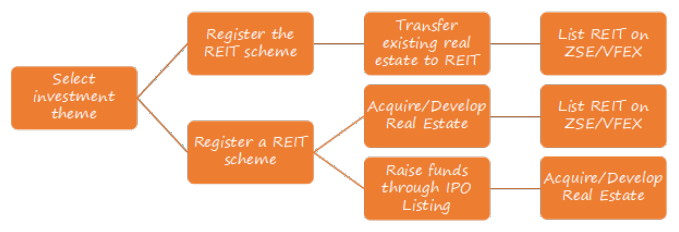

Below is an illustration of how a Pension Fund can List a REIT.

Conclusion

The macroeconomic environment of Zimbabwe has not been friendly and is making life difficult for both pension fund administrators and pension funds. There is a strong need for deviating from the conventional solutions In situations like these where we have annual blended inflation souring at 175% and 98% together with ZWL currency depreciation since its introduction and inconsistent macroeconomic policies. Our environment is unique and required extraordinary solutions to its problems. Collective Investment Schemes can go a long way to ensure that pensioners receive something valuable from their pot. Retiring into nothing is no life for anyone. The tax concessions and exemptions around REITs investments for pension funds make the investment very lucrative for an industry that pools a lot of money (ZW$42b as at 31 March 2023) and requires high levels of liquidity to be able to service its 981,889 members.

Musawenkosi Dzheka is an aspiring Financial Analyst. He is currently undertaking his Btech Honors Degree in Financial Engineering with Harare Institute of Technology. He was part of the CFA Equity Research Challenge finalists with HIT in Feb 2023. He is currently attached at Zimbabwe Association of Pension Funds. Musawenkosi enjoys quantitative financial research and writing articles.